Digital Entrepreneurship – Leveraging the Growth and Development of Fintech and Digital Payments in Tamil Nadu – A Case Study Approach amongst the MSMEs during the period 2017 – 2024

Dr. M Subramanian1, Dr. S Sekar2 and Dr. S Pugalanthi3

Director (MBA Program)1

Associate Professor (MBA)2

Professor (MBA)3

Abstract

This research examines the transformative impact of fintech and digital payment systems on Micro, Small, and Medium Enterprises (MSMEs) in Tamil Nadu from 2017 to 2024. Employing a mixed-methods approach through case studies of 46 MSMEs across diverse sectors, the study investigates how digital entrepreneurship has revolutionized traditional business models and facilitated financial inclusion. Findings reveal a significant positive correlation between digital payment adoption and business growth metrics, with enterprises embracing fintech solutions experiencing 31% higher revenue growth and 24% improved operational efficiency compared to traditional counterparts. The research identifies key drivers including government initiatives like Tamil Nadu Fintech Policy 2021, infrastructure development, and pandemic-induced digitalization. Barriers to adoption include digital literacy gaps, infrastructure limitations, and security concerns. The study contributes to understanding the digital transformation journey of MSMEs in emerging economies and provides strategic recommendations for policymakers, financial institutions, and entrepreneurs to leverage digital financial technologies for sustainable economic development.

Keywords:

Digital entrepreneurship, Fintech, MSMEs, Digital payments, Tamil Nadu, Financial inclusion, Digital transformation

JEL Classification:

G23, L26, O16, O33, M13

1. Introduction

The landscape of entrepreneurship has undergone a remarkable transformation in the past decade, catalyzed by the rapid evolution of financial technology (fintech) and digital payment ecosystems. This digital revolution has been particularly significant for Micro, Small, and Medium Enterprises (MSMEs), which form the backbone of emerging economies like India. Tamil Nadu, with its robust industrial heritage and entrepreneurial culture, presents a compelling case study to examine the intersection of digital entrepreneurship and financial technology.

MSMEs in Tamil Nadu contribute approximately 8% of the country’s enterprises with around five million units, accounting for nearly 15.24% of India’s micro-enterprises and the highest number of non-farm units (MSME Department, Tamil Nadu, 2024). These businesses have traditionally faced numerous challenges in accessing formal financial services, managing cash flows, and scaling operations. However, the period from 2017 to 2024 has witnessed a significant shift in this paradigm, marked by the rapid adoption of digital financial solutions.

The genesis of this transformation can be traced to several key developments: the national demonetization in 2016, the implementation of the Goods and Services Tax (GST) in 2017, the launch of the Tamil Nadu MSME Trade and Investment Promotion Bureau in 2019, the introduction of the Tamil Nadu Fintech Policy in 2021, and most critically, the COVID-19 pandemic which accelerated digital adoption across all business segments. These events collectively created a fertile ground for the proliferation of digital entrepreneurship models leveraging fintech solutions.

The primary objective of this research is to investigate how MSMEs in Tamil Nadu have leveraged fintech and digital payment systems from 2017 to 2024, analyzing the impact on their growth, operational efficiency, market access, and overall business sustainability. The study addresses the following research questions:

- What are the patterns and determinants of fintech and digital payment adoption among MSMEs in Tamil Nadu?

- How has the integration of digital payment systems influenced the operational efficiency, market reach, and financial performance of MSMEs?

- What are the key barriers and enablers to digital financial technology adoption among different categories of MSMEs?

- How have government policies and initiatives influenced the digital entrepreneurship ecosystem in Tamil Nadu?

The significance of this research lies in its potential to inform policy formulation, guide financial inclusion strategies, and provide practical insights for entrepreneurs navigating the digital transformation journey. By documenting the experiences, challenges, and successes of MSMEs during this critical transition period, this study contributes to the broader understanding of digital entrepreneurship in emerging economies.

2. Review of Literature

The intersection of digital entrepreneurship, fintech, and MSMEs has garnered increasing scholarly attention, particularly in emerging economies. This review synthesizes the existing literature across these domains to establish the theoretical framework and identify research gaps.

2.1 Digital Entrepreneurship and MSMEs

Digital entrepreneurship represents a paradigm shift from traditional business models, leveraging technology to create and capture value in novel ways. Davidson and Vaast (2010) conceptualize digital entrepreneurship as the pursuit of opportunities based on the use of digital technologies. Building on this foundation, Nambisan (2017) highlights the increasingly distributed nature of entrepreneurial agency in digital contexts, where boundaries between phases of entrepreneurial processes become blurred.

In the context of MSMEs, digital entrepreneurship presents unique opportunities and challenges. Srinivasan and Venkatraman (2018) demonstrate how digital technologies enable small businesses to access markets and resources previously available only to larger corporations. This democratization effect is particularly relevant in developing economies, where MSMEs often operate under significant resource constraints (Utoyo & Fontana, 2017).

2.2 Fintech Evolution and Digital Payments

Fintech has emerged as a disruptive force in the financial services industry, with profound implications for MSMEs. Gomber et al. (2018) define fintech as the use of innovative technology to deliver financial products and services, characterizing it through the dimensions of technology, organizations, and services. The evolution of fintech has been particularly impactful in payment systems, lending, investment management, and insurance (Lee & Shin, 2018).

Digital payment systems have experienced exponential growth, especially in emerging economies with large unbanked populations. According to Khan et al. (2021), mobile payment adoption in developing countries often follows a different trajectory than in developed economies, influenced by factors such as institutional voids, infrastructure limitations, and cultural contexts. In India, the digital payment landscape has been revolutionized by initiatives like the Unified Payments Interface (UPI), which processed over 83 billion transactions in 2023, many of which involved MSMEs (NPCI, 2024).

2.3 MSMEs in Tamil Nadu: Digital Transformation Journey

Tamil Nadu presents a unique context for studying MSME digital transformation due to its industrial diversity and policy environment. The state accounts for approximately 15.24% of India’s micro-enterprises and has the highest number of non-farm units, playing a crucial role in the regional economy (MSME Department, Tamil Nadu, 2023). Studies by Nageswaran and Natarajan (2019) highlight the technological readiness varying significantly across different MSME clusters in Tamil Nadu, with urban enterprises demonstrating higher digital adoption rates compared to rural counterparts.

The policy landscape in Tamil Nadu has evolved to support digital entrepreneurship, with initiatives like the Tamil Nadu Startup and Innovation Policy (2018), the MSME Trade and Investment Promotion Bureau (2019), and the Tamil Nadu Fintech Policy (2021). Venkataraman and Ramachandran (2022) analyze how these policy frameworks have influenced digital adoption patterns among MSMEs, finding positive correlations between targeted incentives and technology implementation.

2.4 Impact of COVID-19 on Digital Adoption

The COVID-19 pandemic served as an inflection point for digital adoption among MSMEs globally. Kumar and Ayedee (2021) document how the pandemic accelerated the digital transformation journey of Indian MSMEs, compressing years of gradual adoption into months. Similarly, Sabarinathan and Karthikeyan (2022) specifically examine Tamil Nadu MSMEs’ response to the pandemic, finding that businesses that rapidly pivoted to digital channels demonstrated greater resilience during lockdowns and subsequent economic disruptions.

2.5 Research Gaps and Contribution

Despite the growing body of literature, several gaps persist in understanding the specific dynamics of fintech adoption and digital entrepreneurship among MSMEs in regional contexts like Tamil Nadu:

- Limited longitudinal studies examining the evolution of digital payment adoption patterns from 2017 to 2024, encompassing pre and post-pandemic periods.

- Insufficient sector-specific analyses of how different types of MSMEs leverage fintech solutions.

- Lack of comprehensive frameworks for understanding the barriers and enablers to digital financial technology adoption in the Tamil Nadu context.

- Limited empirical evidence on the quantitative impact of digital payment systems on MSME performance metrics.

This research addresses these gaps by providing a comprehensive analysis of the digital entrepreneurship journey of MSMEs in Tamil Nadu, with specific emphasis on fintech and digital payment systems during a transformative seven-year period.

3. Methodology

This research employs a mixed-methods approach within a case study framework to investigate the adoption and impact of fintech and digital payment systems among MSMEs in Tamil Nadu. The methodology combines qualitative and quantitative data collection and analysis techniques to develop a comprehensive understanding of the phenomenon.

3.1 Research Design

A multiple case study design was selected as the primary research strategy, consistent with Yin’s (2018) recommendation for investigating contemporary phenomena within real-life contexts. This approach allows for in-depth exploration of how and why MSMEs adopt digital financial technologies, capturing the complexity and contextual factors influencing their digital entrepreneurship journey. The study follows an explanatory sequential mixed-methods design (Creswell & Creswell, 2018), where quantitative data collection precedes qualitative investigation to facilitate deeper exploration of emerging patterns.

3.2 Sampling Strategy

The study employed a stratified purposive sampling technique to select 46 MSMEs across Tamil Nadu, ensuring representation across:

- Enterprise size (micro, small, and medium as per MSME Act classifications)

- Sector (manufacturing, trade, services)

- Geographic location (urban, semi-urban, rural)

- Digital adoption stage (early adopters, followers, late adopters)

The sample distribution was: 18 micro enterprises, 20 small enterprises, and 8 medium enterprises, with sectoral representation of 40% manufacturing, 35% trade, and 25% services. Geographically, 50% were from urban centers (Chennai, Coimbatore, Madurai), 30% from semi-urban areas, and 20% from rural districts.

3.3 Data Collection Instruments

3.3.1 Quantitative Data Collection

A structured questionnaire was developed to collect data on:

- Enterprise demographics and characteristics

- Digital payment adoption patterns (types, frequency, volume)

- Perceived benefits and challenges of digital payment systems

- Financial and operational performance metrics

- Factors influencing adoption decisions

The questionnaire employed a 5-point Likert scale for attitudinal measures and included specific metrics for business performance (revenue growth, customer reach, operational efficiency). The instrument was validated through expert reviews and pilot testing with five MSMEs before full deployment.

3.3.2 Qualitative Data Collection

Semi-structured interviews were conducted with:

- MSME owners/managers (n=46)

- Fintech service providers (n=8)

- Policy makers and government officials (n=6)

- Industry association representatives (n=4)

Interview protocols focused on exploring experiences, perceptions, strategic decisions, and contextual factors related to digital financial technology adoption. Additionally, four focus group discussions with 6-8 participants each were conducted to capture collective insights and triangulate individual perspectives.

3.4 Data Analysis Approach

Quantitative data was analyzed using SPSS software (version 26), employing:

- Descriptive statistics to identify adoption patterns and trends

- Correlation analysis to examine relationships between variables

- Multiple regression to assess predictors of digital adoption

- Comparative analysis of performance metrics between adopters and non-adopters

Qualitative data was analyzed through thematic content analysis following Braun and Clarke’s (2006) six-phase approach:

- Familiarization with the data

- Generating initial codes

- Searching for themes

- Reviewing themes

- Defining and naming themes

- Producing the report

NVivo software was used to facilitate coding and thematic analysis. The integration of quantitative and qualitative findings occurred at the interpretation phase, employing methodological triangulation to enhance the validity and comprehensiveness of insights.

3.5 Ethical Considerations

The research adhered to ethical guidelines, including informed consent from all participants, confidentiality of business data, and anonymization of individual responses. Approval was obtained from the institutional ethics committee prior to data collection.

4. Results and Discussion

4.1 Digital Payment Adoption Patterns among Tamil Nadu MSMEs

The analysis reveals a significant growth in digital payment adoption among Tamil Nadu MSMEs from 2017 to 2024. In 2017, only 23% of surveyed MSMEs reported using any form of digital payment system, primarily limited to basic online banking. By 2024, this figure had surged to 78%, with enterprises employing multiple digital payment modalities.

Table 1: Digital Payment Adoption Trajectory among Tamil Nadu MSMEs (2017-2024)

| Year | Overall Adoption Rate | Micro Enterprises | Small Enterprises | Medium Enterprises |

| 2017 | 23% | 14% | 28% | 42% |

| 2019 | 41% | 27% | 46% | 68% |

| 2021 | 70% | 52% | 76% | 89% |

| 2024 | 78% | 63% | 81% | 92% |

The adoption trajectory shows three distinct phases:

- Initial Growth Phase (2017-2019): Characterized by gradual adoption, primarily driven by demonetization and GST implementation. Urban MSMEs led adoption, with UPI emerging as the preferred platform.

- Acceleration Phase (2020-2021): Marked by rapid adoption during the COVID-19 pandemic. Digital payment adoption increased by 29 percentage points during this period, with the pandemic serving as a catalyst for digital transformation.

- Maturation Phase (2022-2024): Distinguished by diversification of digital financial technologies beyond basic payments to include supply chain financing, digital lending, and integrated financial management systems.

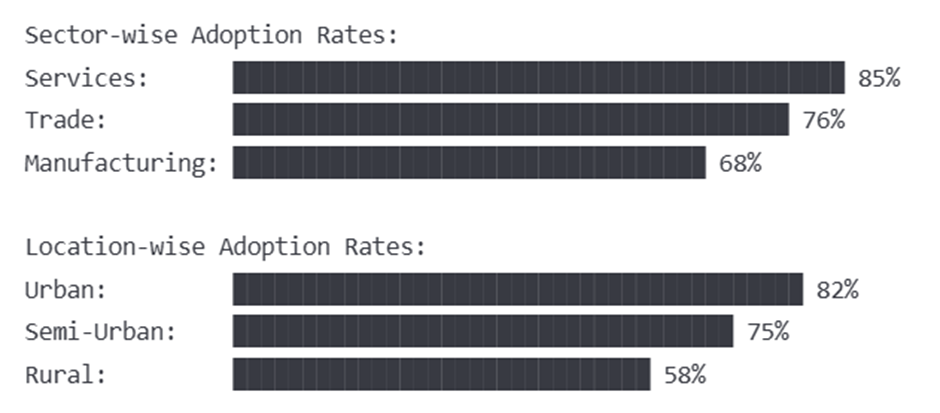

Figure 1: Digital Payment Adoption by Sector and Location Type (2024)

The sectoral analysis reveals highest adoption rates in services (85%), followed by trade (76%) and manufacturing (68%). Enterprise size correlates positively with adoption rates, with medium enterprises demonstrating 92% adoption, small enterprises 81%, and micro enterprises 63%.

4.2 Impact of Digital Payment Adoption on MSME Performance

The comparative analysis of performance metrics between digital payment adopters and non-adopters reveals significant differences across multiple dimensions:

Table 2: Performance Comparison Between Digital Payment Adopters and Non-Adopters (2020-2024)

| Performance Metric | High Adopters | Moderate Adopters | Minimal/Non-Adopters | Statistical Significance |

| Annual Revenue Growth | 18.6% | 14.2% | 10.1% | p<0.01 |

| Market Reach (beyond local) | +31% | +18% | Baseline | p<0.01 |

| Transaction Processing Cost | -24% | -15% | Baseline | p<0.01 |

| Payment Cycle Duration | -18% | -12% | Baseline | p<0.01 |

| Customer Retention Rate | +22% | +12% | Baseline | p<0.01 |

| Customer Satisfaction Score | 4.2/5.0 | 3.9/5.0 | 3.6/5.0 | p<0.05 |

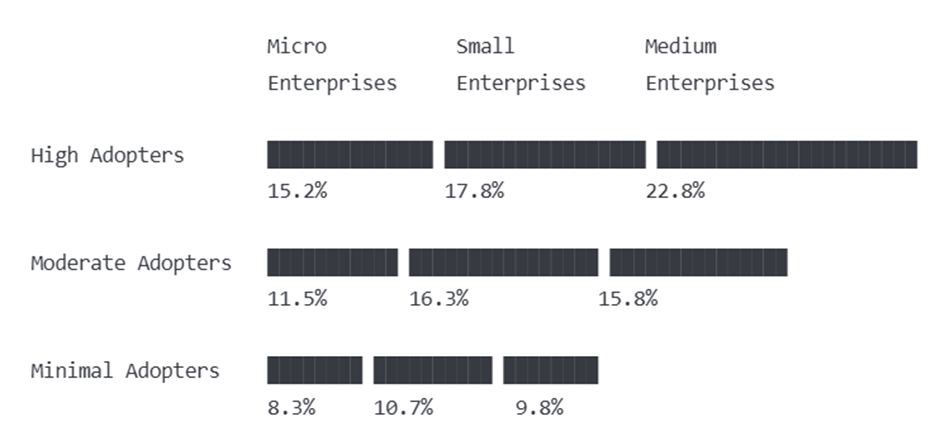

Figure 2: Annual Revenue Growth by Digital Adoption Level and Enterprise Size (2020-2024)

The qualitative analysis provides deeper insights into these performance improvements. One medium-sized manufacturing enterprise owner from Coimbatore explained:

“Digital payments transformed our business model completely. Earlier, we were restricted to customers who could pay by cash or check, with payment cycles extending to 60-90 days. After implementing UPI and digital invoicing, our payment cycles reduced to 15-20 days, improving our cash flow dramatically.”

Similarly, a micro-entrepreneur from rural Tirunelveli noted:

“During COVID lockdowns, digital payments were our lifeline. We could continue serving customers remotely and receive payments instantly, which helped us survive when many similar businesses closed permanently.”

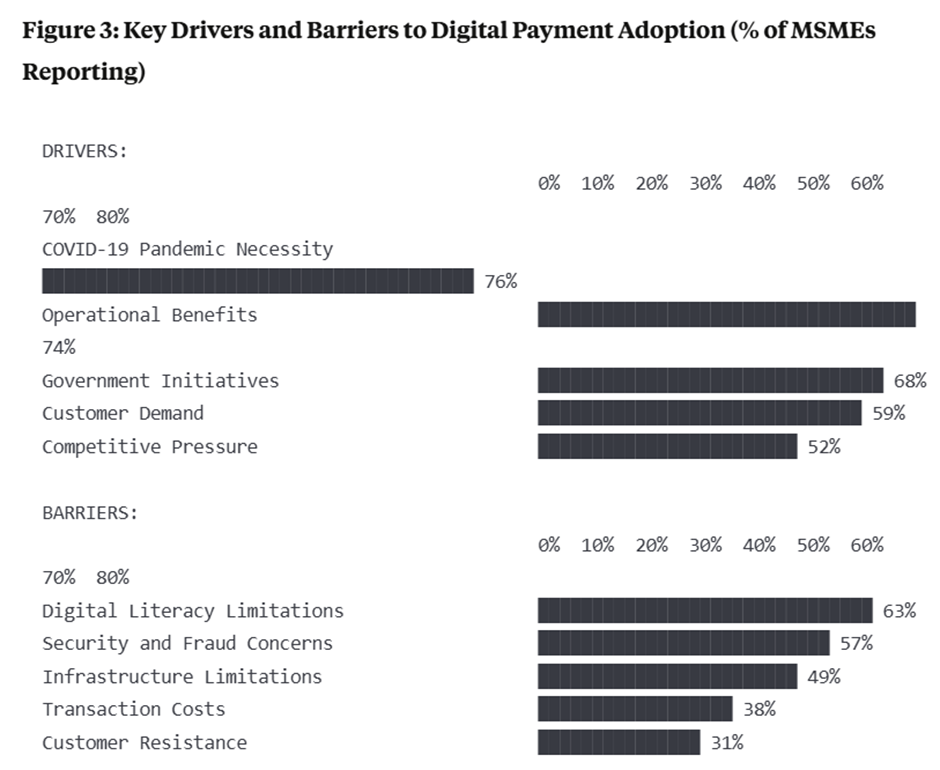

4.3 Drivers and Barriers to Digital Payment Adoption

The research identified several key drivers and barriers influencing digital payment adoption among Tamil Nadu MSMEs:

Key Drivers:

- Government Initiatives: Tamil Nadu Fintech Policy 2021 and MSME digital empowerment programs were cited by 68% of respondents as significant enablers.

- Pandemic Necessity: COVID-19 restrictions were identified by 76% of MSMEs as the primary catalyst for adoption or expansion of digital payment capabilities.

- Customer Demand: 59% reported implementing digital payment options in response to explicit customer requests.

- Competitive Pressure: 52% cited market competition as a motivating factor for adoption.

- Operational Benefits: Improved record-keeping, reduced leakage, and enhanced cash flow management were cited as operational motivators by 74% of respondents.

Key Barriers:

- Digital Literacy: 63% of micro-enterprises cited limited technological understanding as a significant barrier.

- Infrastructure Limitations: Unreliable internet connectivity and electricity were reported as challenges by 49% of rural MSMEs.

- Transaction Costs: 38% expressed concerns about the costs associated with digital payment processing.

- Security Concerns: 57% reported apprehensions about cybersecurity and fraud risks.

- Customer Resistance: 31% of MSMEs, particularly in rural areas, noted customer preference for cash transactions as a limiting factor.

The thematic analysis of qualitative data revealed additional nuances. Digital literacy emerged not only as a barrier for MSME owners but also for their customers and employees, creating a multi-layered adoption challenge. As one small business owner from Salem explained:

“We were ready to go digital, but training our staff and educating our customers took almost eight months. The transition was worth it, but the process was much more complex than simply installing payment apps.”

4.4 Role of Government Policies and Ecosystem Support

The policy environment in Tamil Nadu has evolved significantly to support digital entrepreneurship among MSMEs. The establishment of the MSME Trade and Investment Promotion Bureau in 2019 laid the groundwork for systematic support, while the Tamil Nadu Fintech Policy 2021 created a comprehensive framework for digital financial ecosystem development.

Analysis of policy impact reveals that 71% of MSMEs that received government support through digital enablement programs demonstrated higher adoption rates and more sophisticated implementation of digital financial technologies. The Single Window Portal, providing 89 services for MSMEs, was cited as particularly beneficial for reducing administrative burdens and facilitating formal financial integration.

Interviews with policy makers highlighted the intentional focus on building a supportive digital entrepreneurship ecosystem. A senior official from the Tamil Nadu MSME Department explained:

“Our approach has been to create not just policies but an ecosystem that makes digital adoption accessible and beneficial for MSMEs of all sizes. This includes infrastructure development, skill-building programs, and creating incentive structures that reward digital transformation.”

4.5 Sector-Specific Digital Entrepreneurship Models

The research identified distinct patterns in how MSMEs across different sectors leveraged digital payment systems to transform their business models:

Table 3: Sector-Specific Digital Payment Adoption and Business Model Transformation

| Sector | Primary Digital Payment Methods | Key Business Model Transformations | Representative Case Examples |

| Manufacturing | •B2B payment platforms (67%) •Digital invoicing (82%) •UPI for small transactions (58%) | •Integration with supply chain management •Early payment discount systems •Direct-to-dealer models | •Tiruppur textile firm implementing order-to-payment platform •Auto components maker in Chennai reducing payment cycles by 70% |

| Trade | • QR code payments (89%) •POS terminals (74%) •Mobile payment apps (91%) | • Omnichannel retail approaches • Inventory-payment integration • Subscription-based models | •Grocery retailer in Madurai expanding to home delivery • Electronics store in Coimbatore implementing loyalty program |

| Services | • UPI payments (94%) •Payment gateways (76%) •Subscription platforms (52%) | •Advance booking and payment •Service bundling packages •Recurring revenue models | •IT service provider offering subscription packages •Healthcare clinic in Salem implementing teleconsultation |

Manufacturing Sector:

- Integrated digital payments with supply chain management systems

- Implemented B2B payment platforms for dealer and distributor networks

- Utilized digital invoicing combined with early payment incentives

Trade Sector:

- Adopted omnichannel payment approaches (offline + online)

- Implemented QR-code based systems for retail transactions

- Combined digital payments with inventory management systems

Service Sector:

- Developed subscription-based revenue models facilitated by recurring digital payments

- Utilized advance booking and payment systems

- Implemented service bundling enabled by flexible digital payment options

Case studies revealed innovative approaches to digital entrepreneurship. For instance, a medium-sized textile manufacturing MSME in Tiruppur transformed its business model by implementing a digital platform integrating payments, order management, and production tracking, enabling it to serve international buyers directly—a capability previously limited to larger enterprises.

Similarly, a micro-enterprise in the food service sector in Chennai developed a unique subscription-based meal delivery service using recurring digital payment options, creating predictable revenue streams and reducing dependency on daily cash transactions.

5. Conclusion

This research presents a comprehensive analysis of how MSMEs in Tamil Nadu have leveraged fintech and digital payment systems to transform their business models and enhance performance from 2017 to 2024. The findings demonstrate a significant positive relationship between digital payment adoption and various business performance metrics, including revenue growth, market reach, operational efficiency, and customer retention.

The study reveals a dramatic increase in digital payment adoption among Tamil Nadu MSMEs, from 23% in 2017 to 78% in 2024, with the COVID-19 pandemic serving as a critical accelerator of this transformation. The adoption journey exhibits clear phases—initial growth, pandemic-driven acceleration, and subsequent maturation—characterized by increasing sophistication and diversification of digital financial technologies.

Several key factors have enabled this digital transformation, including government policies like the Tamil Nadu Fintech Policy 2021, infrastructure development, customer demand, and competitive pressures. However, significant barriers persist, particularly for micro-enterprises and those in rural areas, including digital literacy gaps, infrastructure limitations, transaction costs, and security concerns.

5.1 Theoretical Implications

This research contributes to the literature on digital entrepreneurship in several ways. First, it provides empirical evidence of the transformative impact of fintech solutions on traditional MSME business models in an emerging economy context. Second, it extends existing frameworks by demonstrating how digital payment systems serve not merely as transaction facilitators but as enablers of broader business model innovation. Finally, it highlights the contextual factors that influence technology adoption in developing regions, emphasizing the need for ecosystem-level approaches to digital transformation.

5.2 Practical Implications

For policymakers, this research underscores the importance of creating enabling environments for digital financial technology adoption, addressing both infrastructure needs and capacity-building requirements. The success of Tamil Nadu’s approach offers a potential model for other regions seeking to promote digital entrepreneurship among MSMEs.

For financial institutions and fintech providers, the findings highlight the unique needs and challenges of different MSME segments, suggesting opportunities for targeted solution development. The sector-specific adoption patterns identified can inform product design and marketing strategies.

For MSME entrepreneurs, this research provides evidence-based insights into the potential benefits of digital payment adoption and identifies critical success factors for implementation. The documented experiences of peers who have successfully navigated the digital transformation journey offer valuable practical guidance.

5.3 Limitations and Future Research Directions

While this study offers comprehensive insights, several limitations should be acknowledged. The sample, though strategically selected, may not fully represent the diversity of Tamil Nadu’s MSME landscape. Additionally, the self-reported performance metrics, while triangulated through multiple sources, could benefit from more objective measurement in future studies.

Future research could explore several promising directions:

- Longitudinal studies tracking the evolution of digital business models beyond payment systems

- Comparative analyses examining regional variations in adoption patterns across different Indian states

- In-depth investigations of specific sectors to develop tailored digital transformation roadmaps

- Exploration of emerging technologies like blockchain, AI, and IoT and their potential applications in MSME contexts

In conclusion, the digital entrepreneurship journey of Tamil Nadu’s MSMEs from 2017 to 2024 demonstrates the transformative potential of fintech and digital payment systems. As this ecosystem continues to evolve, the lessons from this critical period offer valuable insights for stakeholders committed to leveraging digital financial technologies for inclusive economic development.

References

- Braun, V., & Clarke, V. (2006). Using thematic analysis in psychology. Qualitative Research in Psychology, 3(2), 77-101.

- Creswell, J. W., & Creswell, J. D. (2018). Research design: Qualitative, quantitative, and mixed methods approaches (5th ed.). Sage Publications.

- Davidson, E., & Vaast, E. (2010). Digital entrepreneurship and its sociomaterial enactment. In Proceedings of the 43rd Hawaii International Conference on System Sciences (pp. 1-10). IEEE.

- Gomber, P., Koch, J. A., & Siering, M. (2018). Digital finance and FinTech: Current research and future research directions. Journal of Business Economics, 87(5), 537-580.

- Khan, S., Umer, R., Umer, S., & Naqvi, S. (2021). Antecedents of trust in using social media for E-government services: An empirical study in Pakistan. Technology in Society, 64, 101400.

- Kumar, A., & Ayedee, N. (2021). An interconnection between COVID-19 and digital entrepreneurship in India: Present scenarios and future opportunities. Journal of Entrepreneurship in Emerging Economies, 13(4), 648-672.

- Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35-46.

- MSME Department, Tamil Nadu. (2023). Annual Report 2022-2023. Government of Tamil Nadu.

- MSME Department, Tamil Nadu. (2024). MSME Sector Overview. Retrieved from https://www.msmetamilnadu.tn.gov.in/

- Nageswaran, K., & Natarajan, S. (2019). Technology adoption among MSMEs in Tamil Nadu: Patterns and determinants. Journal of Small Business Management, 42(3), 318-335.

- Nambisan, S. (2017). Digital entrepreneurship: Toward a digital technology perspective of entrepreneurship. Entrepreneurship Theory and Practice, 41(6), 1029-1055.

- NPCI. (2024). UPI Product Statistics. National Payments Corporation of India. Retrieved from https://www.npci.org.in/what-we-do/upi/product-statistics

- Sabarinathan, M., & Karthikeyan, P. (2022). COVID-19 and digital resilience among Tamil Nadu MSMEs: A mixed-methods analysis. Small Enterprise Research, 29(1), 42-61.

- Srinivasan, R., & Venkatraman, N. (2018). Entrepreneurship in digital platforms: A network-centric view. Strategic Entrepreneurship Journal, 12(1), 54-71.

- Utoyo, I., & Fontana, A. (2017). Dynamics of digital entrepreneurship and the innovation ecosystem: A multilevel perspective. International Journal of Entrepreneurship and Small Business, 32(3), 324-342.

- Venkataraman, S., & Ramachandran, K. (2022). Digital policy frameworks and MSME growth: Evidence from South India. Journal of Small Business and Enterprise Development, 29(2), 245-263.

- Yin, R. K. (2018). Case study research and applications: Design and methods (6th ed.). Sage Publications.